Pips Every Day Pips Or A Weekly 500-Pip Bag: Day Trading Against Swing Trading: Comparing Day and Swing

Pips: Every Day Pips Or A Weekly 500-Pip Bag: Day Trading Against Swing Trading Trading: Revealing Profitable Strategies

Making the decision between swing and day trading in the financial markets is crucial for traders who want to succeed. This extensive guide will assist you in navigating the complicated world of trading by revealing the tactics, advantages, and difficulties related to each technique.

Selecting the appropriate trading strategy is essential for success in the ever-changing world of financial markets. Two well-liked strategies, day trading and swing trading, each have their own special qualities and possible advantages. Knowing the differences between these approaches can help traders make well-informed choices that fit their objectives and risk tolerance.

Taking Advantage of Opportunities in a Single Day: Day Trading

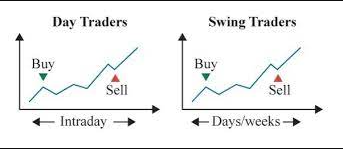

During a single trading day, day traders execute several trades in an attempt to profit from brief market fluctuations.

Techniques:

– Scalping: Making quick, little trades to take advantage of tiny price changes.

– Trend Following: Riding the wave of daily trends that have already been formed.

– Range Trading: Profiting from changes in price that fall into a predetermined range.

Advantages: – Quick decision-making and action.

– No exposure to market dangers over night.

Potential for frequent, rapid financial gain.

Difficulties: – Needs a large time investment during market hours.

– High transaction expenses as a result of regular trading.

Psychological strain resulting from the rapid speed of trading.

Swing Trading: Capitalizing on Trends for Intermediate-Term Gains

Days to weeks may pass as swing trading is conducted with the goal of capturing price fluctuations within a well-established trend.

Strategies: – Trend Reversal: Recognizing potential turning points in trends.

– Breakout Trading: Making money when prices go outside of predetermined ranges.

– Counter-trend Trading: Taking positions that diverge from the direction of the market as a whole.

Advantages: – Less strict trading schedule than with day trading.

– Potentially higher profit objectives in contrast to day trading.

– A longer time horizon results in less market noise.

Difficulties: – Sudden exposure to market hazards.

It takes endurance to wait for deals to go through.

– May pass on the quick opportunities that come with day trading.

Important Things to Think About When Deciding Between Day and Swing Trading:

1. Time Commitment: Swing trading permits a more flexible schedule, but day trading requires active participation during market hours.

2. Risk Tolerance: Day traders must have a higher risk tolerance due to the quick swings in the market. A longer-term view with possibly less extreme price volatility is offered by swing trading.

3. Capital Requirements: The frequency of trades in day trading may result in increased transaction fees, which could affect profitability. Because swing trading involves fewer trades, its associated costs might be lower.

4. Psychological Aspects: The pressure of making fast decisions in day trading demands a disciplined mindset. Swing trading allows for a less stressful trading experience by involving longer spans of time.

The decision between swing trading and day trading ultimately comes down to your capital requirements, risk tolerance, and time commitment. By evaluating these elements, you will be able to match your trading plan to your financial objectives. Whether you choose swing trading or day trading, which moves at a faster speed, the key to success is knowing the nuances of each technique and knowing when to adjust.