Risk Management Effective Ways To Guard Capital in Forex 2024

Risk management For traders hoping to make their way through the volatile currency markets, in Forex is essential. It entails putting plans in place to guard against losses and preserve cash. Profitability may be increased and investments protected with effective risk management.

1. Recognizing Forex Risk:

Trading forex entails the exchange of currencies, which entails inherent risks because of volatility in the market. Geopolitical developments, economic data, and market mood can all affect currency values.

2. Position Sizing:

An important part of risk management is knowing the right size for your position. Traders use their trading account size and risk tolerance to determine how big of a stake to take. This keeps big losses from happening in a single trade.

3. Stop-Loss Orders:

These vital instruments are used to restrict losses. In order to stop losses from increasing past a certain point, traders set preset levels at which their positions would automatically shut.

Take-profit orders give traders the ability to lock in winnings by automatically exiting a position when a predetermined profit threshold is reached. This assists traders in staying within their profit targets and averting possible losses.

5. Diversification:

Spreading out a trading portfolio among various currency pairs helps lower overall risk. By using this tactic, one might lessen their exposure to a single currency’s volatility.

6. Risk-Reward Ratio:

It’s important to figure out and have a positive risk-reward ratio. The prospective profit and probable loss of a trade are compared using this ratio. Gaining trades can balance out losing ones if there is a positive risk-reward ratio.

7. Leverage Management:

Although leverage increases gains, it also increases losses. Leverage must be used carefully and one must be aware of how it affects trading positions in order to effectively manage risk.

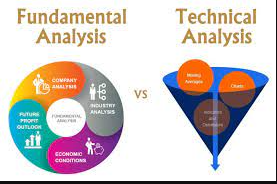

8. Technical and Fundamental Analysis:

Combining the two types of analysis enables traders to make well-informed choices. Traders can enhance their ability to predict market moves and adjust risk by grasping economic information and examining price charts.

9. Keep Up to Date:

Good risk management requires that one be up to date on both geopolitical and international economic happenings. Unexpected occurrences have a big impact on currency markets, and traders can adapt their methods by knowing this.

10. Emotional Control:

Feelings can impair cognition and cause hasty decisions. Effective risk management involves controlling one’s emotions so that one can make analytical decisions without giving in to greed or fear.

11. Backtesting:

In order to evaluate the efficacy of their techniques and spot any potential flaws, traders should backtest them using historical data. Strategies for risk management can be improved and optimized through this approach.

12. Constant Monitoring:

Since markets are always changing, risk management calls for constant observation. Traders need to remain alert and prepared to modify their plans in response to shifting market circumstances.

Keywords: – Forex risk management – position sizing – take-profit and stop-loss orders – forex diversification – risk-reward ratio – leverage management – technical and fundamental analysis – economic indicators – emotional control in trading – backtesting strategies – continuous market monitoring

By applying these risk management techniques, Forex traders may adopt a more methodical and long-term strategy that will aid them in overcoming the difficulties and uncertainties associated with the currency markets.