Market Analyzes: Technical vs. Fundamental Strategies in Forex

Market Analyzes: Technical vs. Fundamental Strategies in Forex Exposing the Workings of Technical and Fundamental Forex Trading Strategies

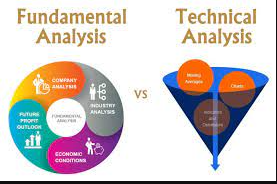

Investors use a range of tactics in the volatile world of Forex trading to help them make sense of the intricate market environment and increase their chances of success. Trading methods are built on two main methodologies: technical analysis and fundamental analysis. Let us examine the nuances of each, comprehending their role in making well-informed decisions and pursuing financial gain.

Technical Evaluation: Interpreting Market Patterns

Examining past price data and trade volumes to spot patterns and trends is the main focus of technical analysis. This approach is predicated on the idea that past price changes can provide clues about how the market will behave in the future. In technical analysis, oscillators, indicators, and charts are essential instruments.

1. Charts: To see how prices are moving, traders frequently utilize candlestick charts. Examined patterns include triangles, head and shoulders, and flags to help forecast future market continuations or reversals.

2. Indicators: Technical indicators include moving averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD). These instruments assist traders in determining a trend’s strength and probable turning points.

3. Oscillators: These indicators aid in determining whether a market is overbought or oversold. For example, the relative strength index (RSI) has a range of 0 to 100. Values above 70 indicate overbought situations, while values below 30 indicate oversold conditions.

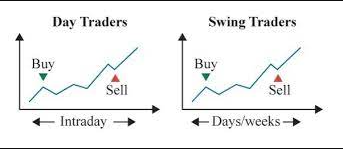

Price action and statistical measurements are the main features of technical analysis, which enables traders to base their conclusions on patterns they have seen in the market. Those who trade short-term with the intention of profiting from intraday or short-term price swings find it especially appealing.

Analyzing Fundamentals: Discovering Economic Factors | Market Analyzes

Fundamental analysis, on the other hand, focuses on assessing social, political, and economic variables that may have an impact on currency prices. This approach makes the assumption that monetary policies, geopolitical events, and economic indicators all have an impact on a currency’s inherent worth.

1. Economic Indicators: To determine the state of a nation’s economy, important economic indicators like GDP growth, unemployment rates, and inflation are carefully examined. A stronger currency is frequently the result of excellent economic performance.

2. Monetary policy and interest rates: Central banks are essential to the functioning of the Forex market. Since policy announcements and interest rate choices have a big influence on currency values, traders keep a careful eye on them. For example, higher interest rates frequently draw in foreign investment, which strengthens a currency.

3. Geopolitical Events: Both geopolitical events and political stability have the power to affect market mood. Currency values can change as a result of diplomatic developments, trade disputes, and elections.

Those who want to make long-term investments and profit from wider economic trends tend to emphasize fundamental analysis. By taking into account a plethora of elements beyond price data, it offers a comprehensive understanding of a currency’s value.

Combining and Using Hybrid Methods to Optimize Insights

Although technical and fundamental analysis are sometimes presented as separate disciplines, proficient traders frequently combine the two methods. Through the integration of knowledge from both approaches, traders are able to make better decisions.

1. Confirmation of Signals: When basic variables are present, technical signals tend to be more reliable. A technical rise, for instance, can have greater credibility if it is supported by favorable economic indications.

2. Risk Management: By evaluating the general sentiment of the market, fundamental research can help traders control risk. Avoiding deals that go against the mood of the market can be made easier by having a better understanding of larger economic patterns.

Gaining an extensive arsenal for navigating the Forex market is possible for traders who understand the subtleties of both technical and fundamental analysis. Fundamental research reveals the larger economic factors at work, whereas technical analysis sheds light on the short-term price swings. Traders can increase their chances of success in the complex world of Forex trading by using a balanced strategy that combines components of both techniques. This allows traders to make better informed decisions.